A banking and finance course will help you discover many opportunities in a reputable and profitable business.

It will also equip you with important skills and knowledge that can help you personally and professionally.

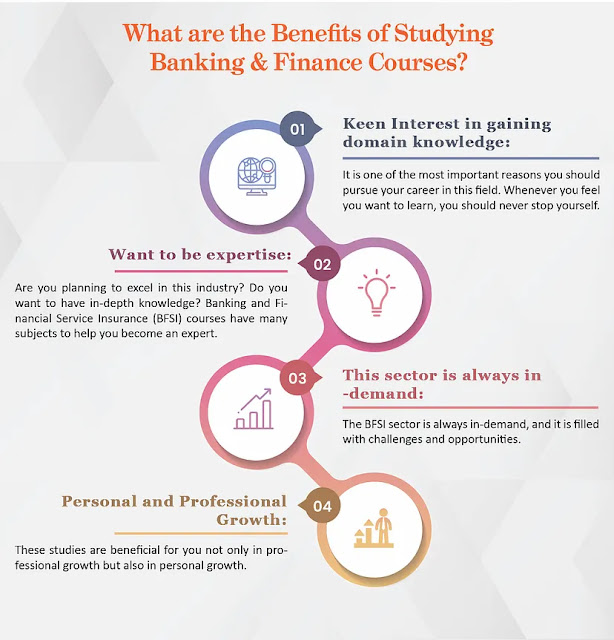

Studying a banking and finance course can provide numerous benefits.

Here are some key advantages:

1. Career Opportunities:

The banking and finance industry offers a wide range of career options.

You can increase your productivity by taking a course in this sector, as gaining specific knowledge and abilities will make you attractive to employers in banks, financial institutions, investment firms, and similar businesses.

2. Financial Literacy:

A banking and finance course equips you with essential financial knowledge.

You learn about financial markets, investment strategies, risk management, and banking operations

3) Job Security:

A Certificate Course in Banking and Finance is known for its stability and resilience.

Studying this course can provide you with long-term job security.

4) Networking Opportunities:

During your studies, you will have the chance to interact with academic scholars, business leaders, and other students in the field with similar interests.

You can develop a strong professional network with them, which can further lead to acquiring mentorship, internships, and employment opportunities.

5) Transferable Skills:

A banking and finance certificate course enhances your analytical, problem-solving, and critical thinking abilities.

You develop financial analysis, data interpretation, and decision-making skills that can be applied across various industries and roles, not just finance.

Read also: How to Develop Critical Thinking Skills?

6) Competitive Edge:

In today’s competitive job market, having a specialized degree in banking and finance sets you apart from other candidates.

7) Global Opportunities:

The banking industry operates on a global scale. With a degree in this field, you can explore opportunities internationally.

Read More: Advantages of Studying Banking Course

To avail of these benefits, a student can choose a valid certificate course with accredited certifications.

One such program is the Thadomal Shahani Center for Management’s Investment Banking

TSCFM’s Investment Banking Program has been created by banking experts and aims to develop business marketing, financial management, and global management skills in candidates.

The course focuses on training individuals with the knowledge required to manage clients globally.